Using PRESTO ensures the best value and lowest fare for customers, offering a $10 savings for every 10 trips. Customers travelling on Durham Region Transit (DRT) can also download and use the new PRESTO E-Tickets app and save the $4 card fee. Android users can pay their fare by tapping a digital version of the PRESTO card in Google Wallet, on an Android smartphone or Wear OS smartwatch.

Please note that all DRT Monthly passes are available for purchase from the 21st of the month prior, until the 15th of the desired month. Example: September Monthly Passes are available from August 21st to September 15th.

The following fare rates are effective July 1, 2023. This fare increase is part of DRT's 10-year strategy to invest in service enhancements, transition to a battery electric fleet, and offer new facilities and amenities.

The following 2023 fare rates are in effect:

| Adult |

- Single trip PRESTO tap: $3.35

- Monthly PRESTO Pass: $120.60

- Cash (exact change only), debit and credit payment: $4.35

|

| Youth - Ages 13 to 19 |

- Single trip PRESTO tap: $3.00

- Monthly PRESTO pass: $96.50

- Cash (exact change only), debit and credit payment: $4.35

| Y10 Youth Monthly Pass - September 2023 - June 2024 |

|

Start the school year off right with flexible and convenient transit. Customers ages 13 to 19 can purchase a Y10 monthly pass and pay only $78.40 per month for unlimited travel – that’s a $181.00 savings over 10 months! Passes will be available for purchase each month from September 2023 through June 2024.

The savings continue all year long. Customers who purchase a pass every month from September until June will save $18.10 on each Y10 monthly pass, for a total of $181.00 in savings.

Customers can visit one of the following DRT PRESTO Points of Sale (POS) by September 15, 2023 to purchase a pass:

- Pickering Town Centre Guest Services

- DRT Customer Service (110 Westney Road South, Ajax)

- Durham Region Headquarters (605 Rossland Rd E, Whitby)

- Oshawa Centre Guest Services

- Scugog Municipal Office (181 Perry Street, Port Perry)

For subsequent months, the Y10 monthly pass can be purchased online at prestocard.ca or at any DRT PRESTO POS.

Please note that Y10 passes, along with all other monthly passes, are available for purchase from the 21st of the month prior until the 15th of the desired month. Example: the September Y10 Pass is available for purchase from August 21st to September 15th.

Be sure to follow us on X (Twitter) for monthly reminders throughout the year: if you don’t purchase every month, you will not be eligible to save in future months. Don’t delay, get the Y10 monthly pass today!

And don’t forget, all kids ages 12 and under ride DRT for FREE. No special passes or tickets are required.

*Terms and Conditions

Y10 Monthly passes are available on physical PRESTO cards and are not available through the PRESTO E-Tickets app.

Please note that eligibility for the Y10 monthly pass requires that a Durham Region Transit Y10 concession is applied, and a Y10 Monthly pass is purchased by September 15, 2023. This can be completed by:

- Presenting identification that includes date of birth at a DRT PRESTO POS location: Pickering Town Centre, DRT Customer Service in Ajax, Durham Region Headquarters in Whitby, Oshawa Centre, or Scugog Municipal Office.

- The Y10 concession can be loaded onto an existing PRESTO card, or a new card can be purchased for $4.00.

To continue receiving the Y10 monthly pass and save more than $18 each month, customers must purchase the Y10 monthly pass every month from September 2023 through to June 2024. If a pass is not purchased for a month, the discount will not apply for the remainder of the promotional period and the regular Youth monthly pass rate of $96.50, will be charged.

|

|

| Senior - Ages 65 and older |

- Single trip PRESTO tap: $2.20

- Monthly PRESTO pass: $48.25

- Cash (exact change only): $3.20

- Debit and Credit payment: $4.35

|

| Child - Ages 12 and under |

- Ages 12 and under: Free of Charge

|

| ACCESS pass and Transit Assistance Program (TAP) |

|

On November 1, 2019, Durham Region Transit launched the Transit Assistance Program (TAP) to improve transit access and affordability for customers currently receiving Social Assistance in Durham Region.

With TAP, you can pay as you go, or pay monthly, and have unlimited access to DRT services for the month. With pay as you go you pay for the first 14 trips in a month up to $46.90* and then ride at no charge for the remainder of the month. With the monthly pass you can pay $46.90 up front and ride all you want.

You can bring your monthly social assistance statement to the following DRT PRESTO point of sale locations to show your eligibility for TAP or to renew your TAP eligibility:

- Oshawa Centre Guest Services (419 King Street West, Oshawa)

- Durham Region Headquarters (605 Rossland Road East, Whitby)

- DRT Customer Service Centre (110 Westney Road South, Ajax)

- Pickering Town Centre Guest Services (1355 Kingston Road, Pickering)

- Scugog Municipal Office (181 Perry Street, Port Perry, ON)

Once purchased, the TAP is valid for six-month periods with a PRESTO card that allows you to:

- add money to your card at any DRT PRESTO point of sale, on PrestoCard.ca or by downloading and installing the PRESTO app to your smartphone

- register your card to protect your money if the card gets lost or stolen

- keep and use the PRESTO card even if your TAP ends

- OW clients should contact their Social Services caseworker and ask about receiving a pre-loaded PRESTO card with the TAP concession applied

In accordance with the ODSP and OW statement, all members of a family unit are eligible for the program.

Customers can also have the TAP concession set on an existing card by visiting a DRT PRESTO point of sale and bringing their monthly statement as proof of eligibility.

* Please review the following terms and conditions:

- Loading values to your PRESTO card online can take up to 24 hours. Please plan your trips accordingly, and call PRESTO directly at 1-877-378-6123 or visit prestocard.ca for more information.

- You can use your existing PRESTO card for the TAP; please note that once the TAP concession is loaded onto your card, it will override any other concessions.

Click here to view this information as a printable PDF file.

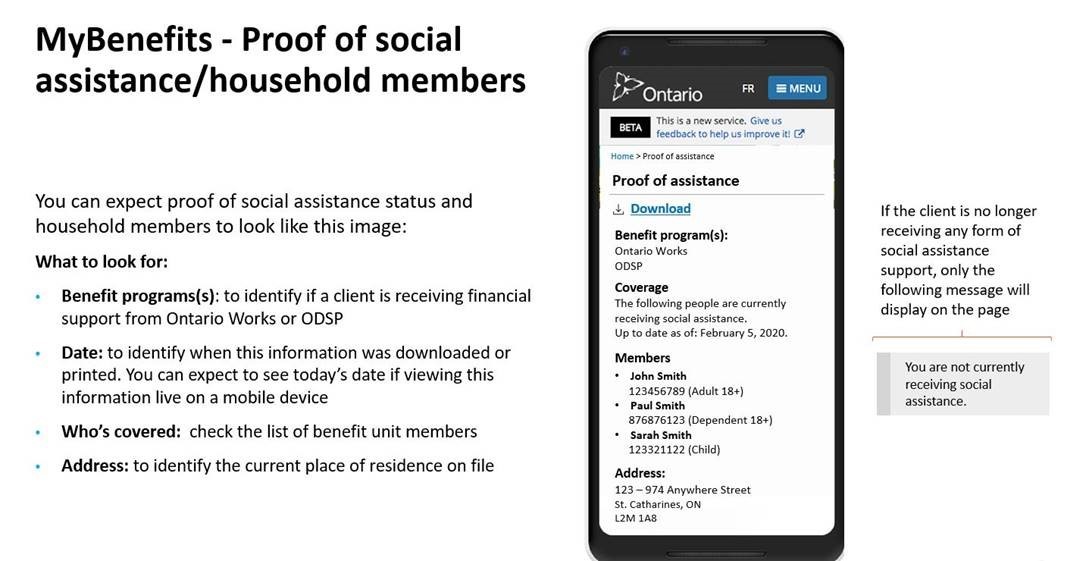

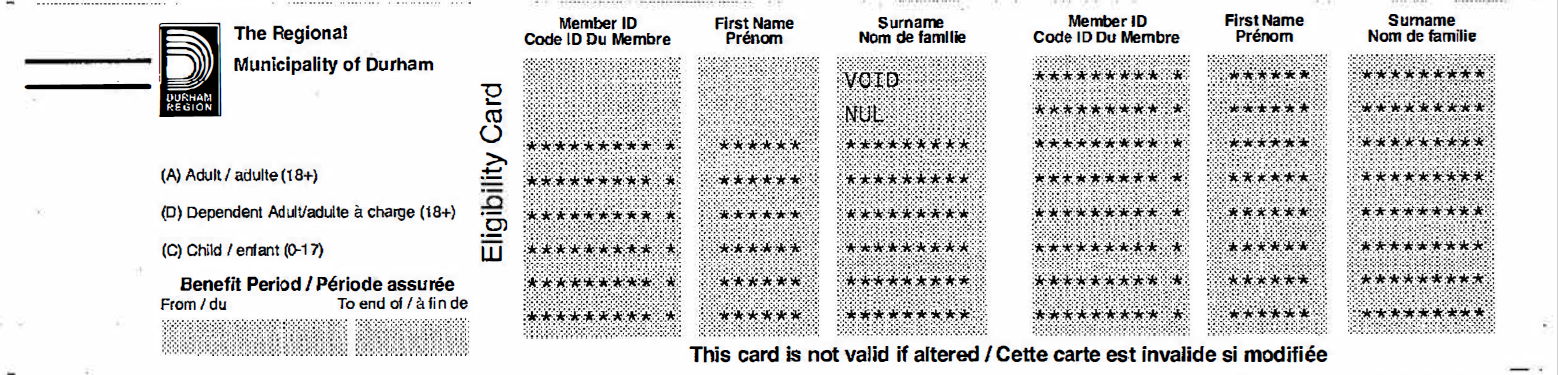

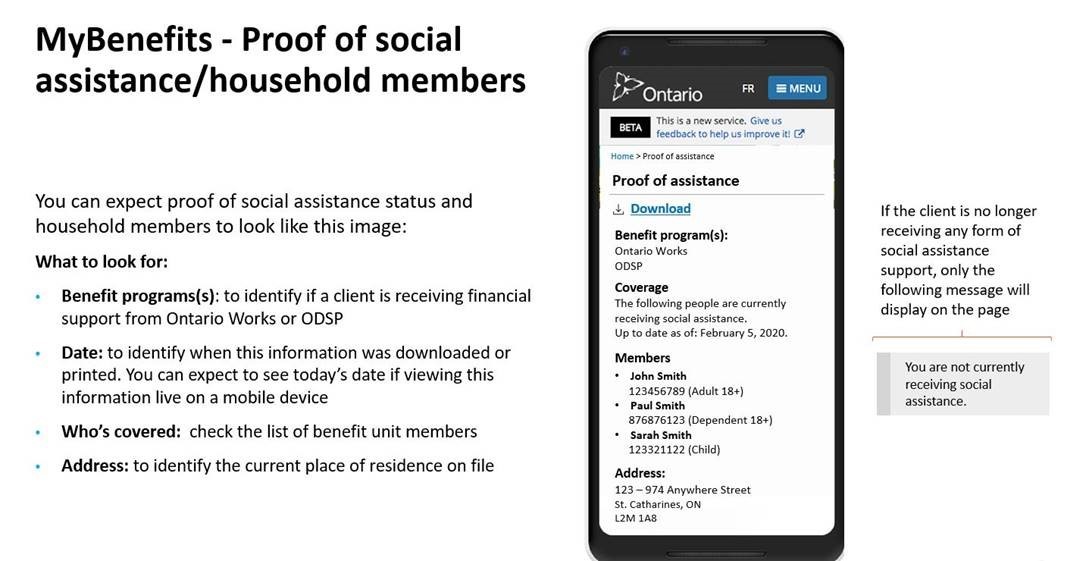

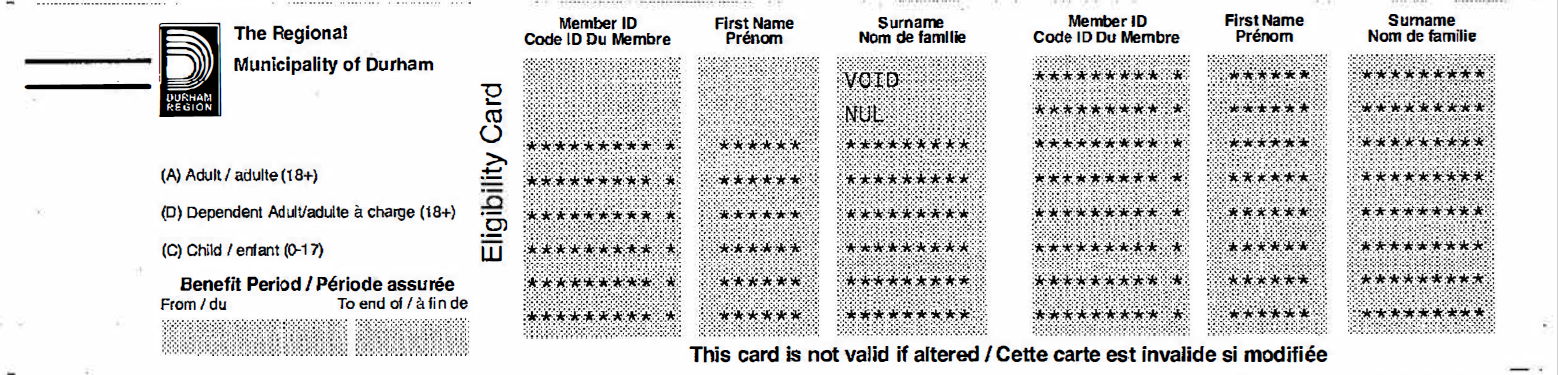

| Acceptable proof of assistance examples |

|

|

|

| Co-Fare - Connecting to or from GO Transit |

- Single trip PRESTO tap: free

- Fare is automatically calculated to provide free service when connecting to or from a GO train or bus.

- Cash: Free when presenting a valid GO Transit Single Ride Ticket or Day Pass.

- Present your valid GO Transit Single Ride Ticket or Day Pass to the operator when boarding DRT.

* As of March 14, 2022, travel for free on DRT when transferring to or from GO Transit. For more details on the co-fare agreement, visit prestocard.ca.

|

|

One Fare Program

|

|

|

*Note that monthly passes are non-refundable. DRT does not reimburse for transit, cab or ride sharing fares or fees. All sales are final.